Businesses are picking up speed. Your competitor is keeping those customer relationships in check, they know it is more important than ever! Then, how can you ignore the CRM systems like Microsoft Dynamics 365 which are the behind-the-scenes heroes of “customer relationship management” in modern times?

Dynamic 365 is a cloud-based suite of enterprise applications. It is built on Common Data Service (CDS) and packed with ERP & CRM Capabilities. Simply put, it has everything that it takes to make sales, customer service, and finance a breeze.

As more businesses catch on to its perks, the demand for specialized Dynamics 365 finance consultants is rising. But, why consulting? In this article, we’ll explore the importance of this vital topic.

What’s the Importance of Dynamics 365 finance consultants?

Before we begin, let’s all know that Dynamics 365 finance consultants are the ones who have expertise in the financial field with Dynamics 365. From the first setup and personalization of the financial components to the continuing maintenance and optimization, these experts can manage a variety of services.

These professionals make sure the system meets an organization's budgetary needs. Dynamics 365 finance consultants also help oversee personnel training, and data migration, while integrating the system into the organization. Beyond the technical work, they offer insights to improve financial operations.

Essential Dynamics 365 Finance Services: Why Are They Special?

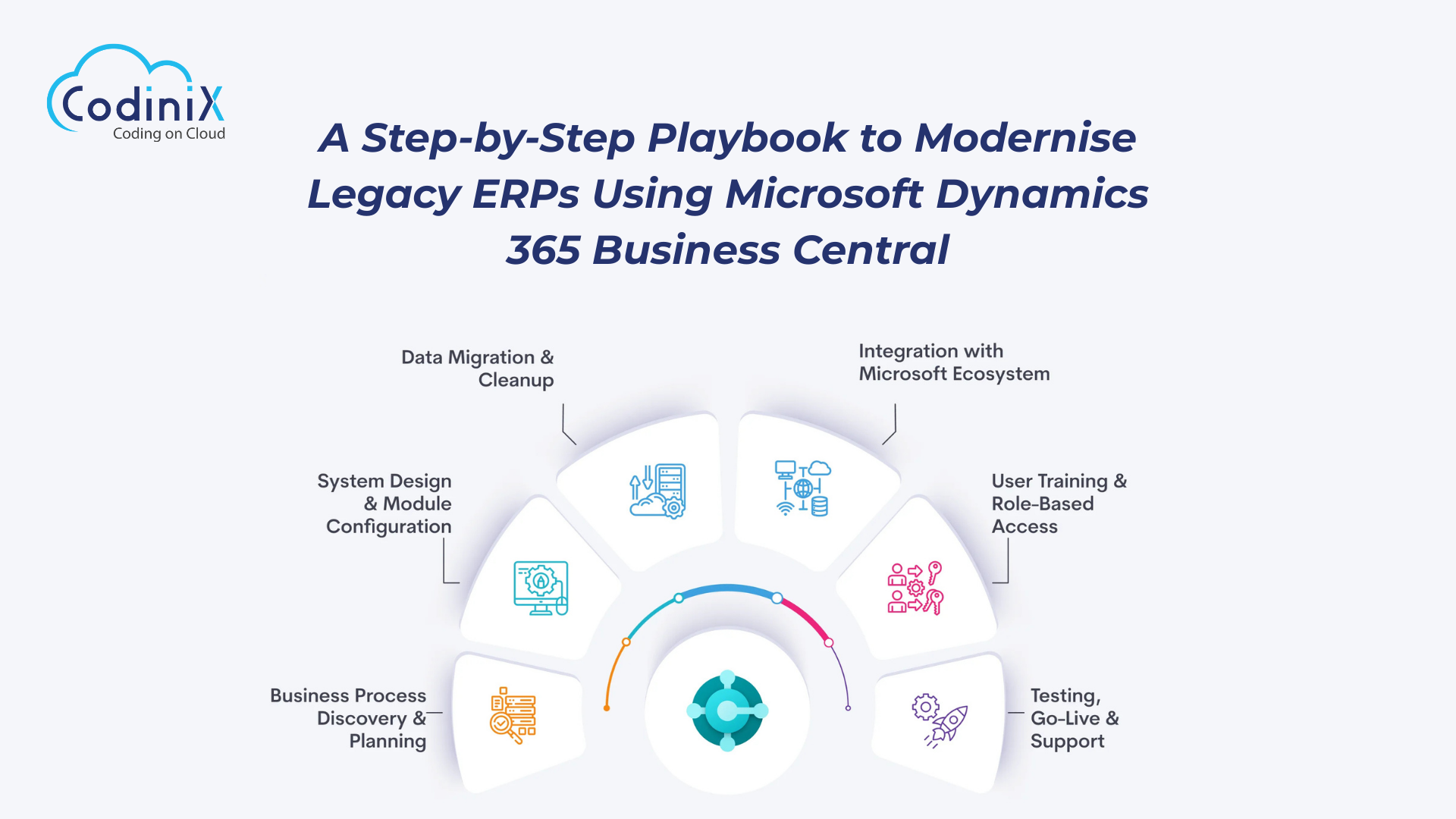

Dynamics 365 finance consulting services are made to fit the needs of businesses. They're especially useful for those who want to make the most of the platform's financial tools. These services typically include:

- System Implementation: Configuring Dynamics 365 to meet the financial requirements of the company and make sure it integrates seamlessly with current systems. Building a robust financial management system to assist day-to-day operations is the goal.

- Customization: Since every company has different financial procedures, a universally applicable solution would not be effective. Consultants create new reports, integrate third-party apps, (e.g., Power Apps, Power Automate, Power BI), and adapt workflows in Dynamics 365 to align with these processes.

- Data Migration: It might be challenging to transfer financial data from outdated systems to Dynamics 365. Consultants minimize any disturbance by ensuring this transition is correct and seamless. To make sure the data moves properly, they clean, map, and verify it.

- Training and Support: The financial staff must understand how to operate the system correctly after it has been set up. To guarantee that staff members can operate the system efficiently, consultants offer training. To keep the system functioning properly and meet the needs of the company, they also provide continuous support.

- Optimization: The system may require modifications as companies expand and their financial requirements shift. For that, to keep the system effective, consultants assist in finding areas for improvement.

How does Dynamics 365 Finance Consultant Bring a Difference?

There are several advantages to hiring a Dynamics 365 finance consultant.

- First, these experts help set up the system and understand how best the platform must be managed to suit the business. This reduces the risk of costly errors and ensures the organization can fully leverage Dynamics 365’s capabilities.

- Second, consultants can offer special strategic advice and guidance. Their work is not only to set it up technically; they teach how to utilize it for growth in businesses. They assist organizations to gain better financial outcomes and more effective financial choices through efficiency of operation, improved control of financial resources, and effective preparation of accounts.

- Finally, ongoing support is a key benefit. Consultants make sure the system is well-ready as the business expands along with its requirements. Overall, they are quite essential to supporting the system's effectiveness over time.

Why Choose Dynamics 365 for Finance?

Dynamics 365 is highly ranked and also preferable in the CRM industry. It is considered one of the best when it comes to its financial depth. It is an entire suite of applications that enables businesspeople to better control their financial management processes such as budgeting, forecasting, and reporting.

The most noteworthy feature that can be attributed to Dynamics 365 is its complementarity with the other products developed by Microsoft. It integrates programs and systems pretty well allowing businesses to extract more comprehensive information that will help them make smart decisions.

Also, the program is scalable, meaning that organizations can configure it and change it as per the requirement. It is a fact that the platform is good for extreme flexibility and allows the creation of custom workflows, managing third-party applications, and developing peculiar financial reports for every single penny.

Conclusion

Finally, Dynamics 365 finance consulting services gain significance as businesses strive to solve more complex finance problems with technology. Already many companies are working closely with these skilled consultants to reach maximum value of their investment in Dynamics 365 and be successful in the future.

Leave Your Thoughts!!