Microsoft Dynamics 365 for Finance and Operations is an enterprise resource planning (ERP) solution that helps businesses manage their financial and operational processes. It is a cloud-based solution that integrates with other Microsoft products, such as Office 365 and Power Platform, to provide a comprehensive suite of tools for managing your business. In this article, we are going to discuss the various benefits, and implementation and also look at the providers.

Advantages of Microsoft Dynamics 365 for Finance and Operations

1. Comprehensive financial management

Dynamics 365 for Finance and Operations provides powerful financial management capabilities, including budgeting, financial reporting, and cash flow management.

2. Robust supply chain management

It provides end-to-end supply chain management capabilities, including procurement, inventory management, demand forecasting, and production planning. This can help businesses improve their efficiency and reduce costs.

3. Real-time business insights:

Offers real-time access to key business metrics, such as sales, inventory levels, and customer information that can help businesses make data-driven decisions and respond quickly to changing market conditions.

4. Flexibility and scalability

It is a flexible and scalable system that can be customized to meet the specific needs of a business. It can be used by businesses of all sizes, from small startups to large enterprises.

5. Cloud-based platform

As it is a cloud-based platform, which means businesses can access it from anywhere with an internet connection. This makes it ideal for businesses with remote workers or multiple locations.

6. Integration with other Microsoft products

Dynamics 365 for Finance and Operations integrates with other Microsoft products, such as Office 365, Power BI, and PowerApps. This can help businesses streamline their workflows and improve collaboration between different departments.

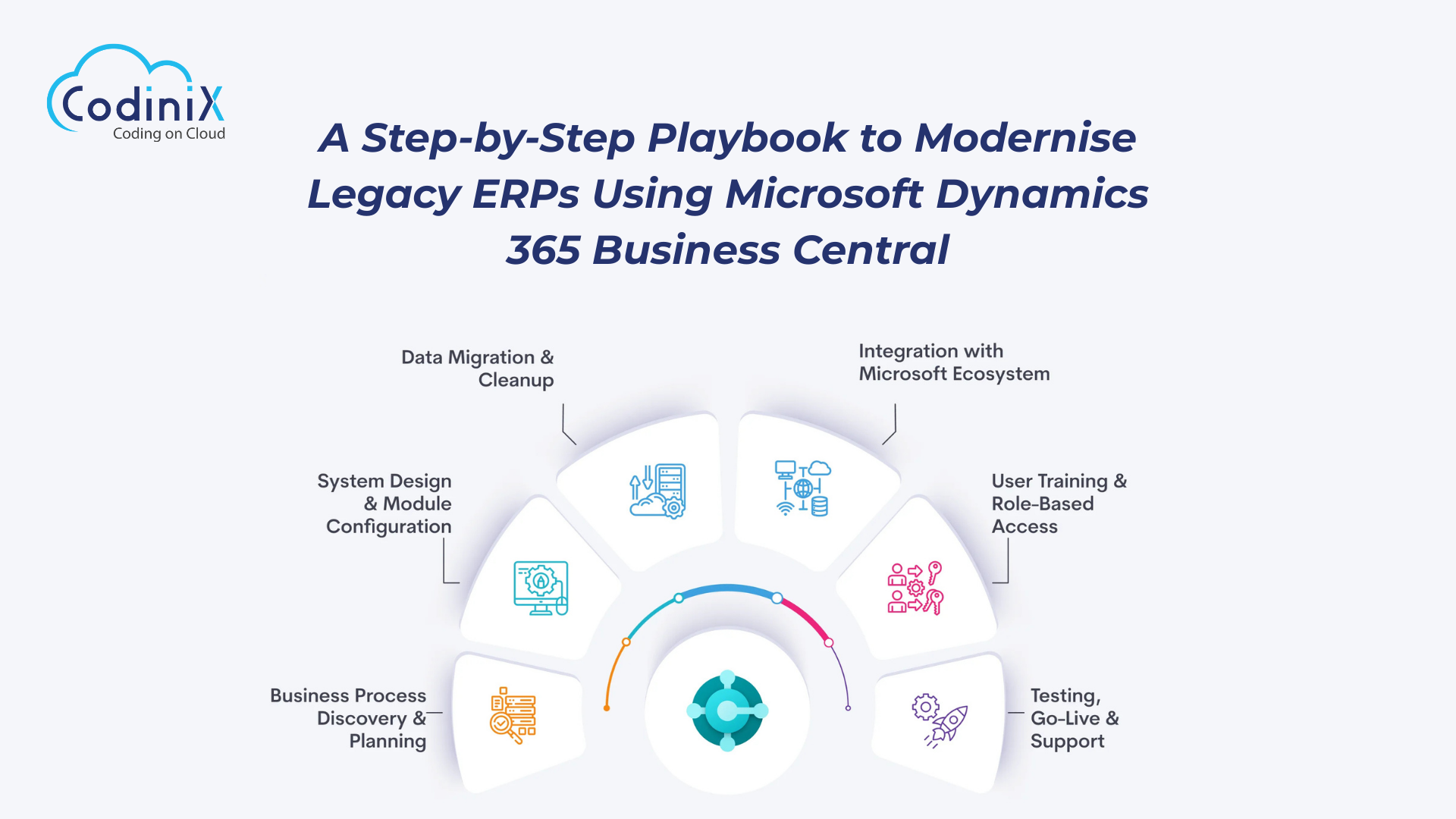

Microsoft Dynamics Finance 365 Implementation

Implementing Microsoft Dynamics Finance 365 involves several steps, including planning, configuration, customization, data migration, testing, and deployment. Here's an overview of the typical implementation process:

- Planning: The first step is to define your project goals, timeline, and budget. You'll need to identify your key stakeholders and create a project team to manage the implementation.

- Configuration: Next, you'll configure the system to meet your business needs. This involves setting up users, security roles, and permissions, as well as defining your chart of accounts, financial dimensions, and other settings.

- Customization: Depending on your specific requirements, you may need to customize the system to meet your unique business processes. This could involve creating custom workflows, forms, reports, or integrations with other systems.

- Data migration: Once the system is configured and customized, you'll need to migrate your data from your existing system to Dynamics 365. This can be a complex process and requires careful planning and testing to ensure data accuracy.

- Testing: Before deploying the system, you'll need to thoroughly test it to ensure that it meets your business requirements and is free of errors or issues.

- Deployment: Once testing is complete, you can deploy the system to your production environment. This involves training your users on the new system and ensuring that all processes are running smoothly.

- Support: After deployment, you'll need to provide ongoing support and maintenance to ensure that the system continues to meet your business needs and remains up-to-date with the latest updates and patches.

Microsoft Dynamics Finance 365 implementation can be a complex process that requires careful planning, coordination, and testing. Working with a certified implementation partner can help ensure a successful implementation and provide ongoing support and maintenance to help your business get the most out of the system.

Choosing a Microsoft Dynamics Finance 365 service provider can provide many benefits for your business. Here are some of the key reasons why you might choose to work with a Dynamics 365 service provider:

- Expertise: Microsoft Dynamics 365 for Finance and Operations is a complex and powerful system, and working with a service provider who has expertise in this area can help ensure that your implementation is successful.

- Scalability: Dynamics 365 for Finance and Operations is a scalable system that can be customized to meet the needs of businesses of all sizes.

- Reduced risk: Implementing a new ERP system is a complex and risky process. Working with a Microsoft Dynamics Finance 365 agency can help reduce the risk of implementation failure or other issues by providing expertise and guidance throughout the process.

- Ongoing support: It requires ongoing maintenance and support to ensure that it continues to meet your business needs and with Microsoft Dynamics Finance 365 service providers you can get ongoing support and help you stay up-to-date with the latest updates and patches.

Final Verdict

That brings us to the end of our article. Overall, Microsoft Dynamics 365 for Finance and Operations is a comprehensive ERP solution that can help businesses manage their financial and operational processes, gain insights into their performance, and make informed decisions.

Leave Your Thoughts!!